Netherlands

Employee Notification Form - (as of May 2017) is not required.

Compensation to the national minimum wage for working time on the territory of the Netherlands can be calculated as follows:

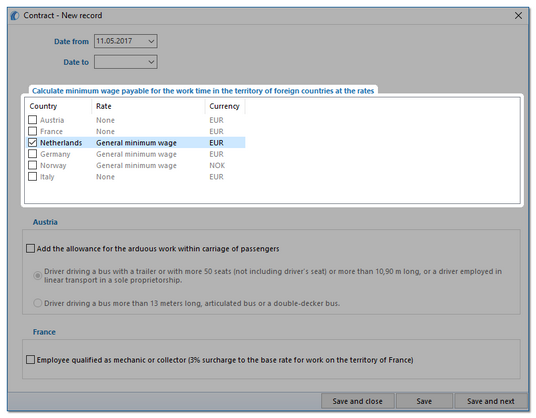

1.In the add/edit employment window ("Basic data -> [005] Employees" menu -> add or open for editing a selected employee, go to "Employment" tab, then open for editing or add a new employment, and then in the Calculate minimum wage payable for the work time in the territory of foreign countries at the rates table select the appropriate country (Fig. bellow).

•edit rate - double-click with the left mouse button on the with the name of the country;

▪minimum wage - adopts the minimum wage amount (total minimum wage) listed in the: "Minimum wages in foreign contries" (menu: "TachoScan");

•checking the option/editing rate for multiple drivers:

▪go back to the list of employees;

▪use the ![]() or

or ![]() key and left mouse button to select the employees (

key and left mouse button to select the employees ( ![]()

![]()

![]() - select all empolyees);

- select all empolyees);

▪right click to display drop-down menu;

▪in the menu, select: Alter data for selected items -> Modify current contract -> Allowance for work time in foreign country;

▪the program will display a table - select the appropriate country and then double-click with the left mouse button to open the compensation rate editing window;

2.Make sure you have complete data downloaded from the driver card and/or scanned from record sheets for the calculated period of time.

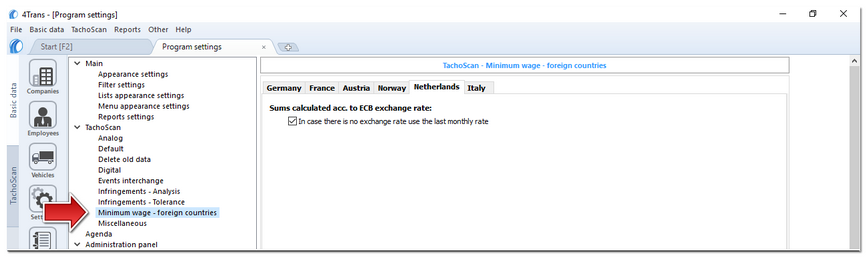

3.In the program settings window, in the: TachoScan -> Minimum wage - other countries tab ("Basic data" -> "Settings" menu) there are options that directly affect the calculation of the national minimum wage compensation. (see more in "Minimum wage - other countries" topic).

We encourage you to review the options - we recommend using the default program settings (![]() ).

).

4.In the Entering and leaving a foreign country territory window ("TachoScan" menu) add the periods of stay (settlement month + next day) in the territory of the selected country for the settled employee/employees. Periods can be entered as follows:

•directly in the program - click on the: ![]() icon in the list toolbar, and then fill in the data in the boxes (Fig. bellow);

icon in the list toolbar, and then fill in the data in the boxes (Fig. bellow);

The section that has the option selected |

|

•Import from csv, xls or xlsx file - click: ![]() , select files, select:

, select files, select: ![]() ;

;

In the import window, there are buttons to download a template or sample import file - see in the: "Entering and leaving a foreign country territory" topic) You can import multiple files at once for different drivers: |

|

•Import from xml file - click: ![]() , select file, select:

, select file, select: ![]() ;

;

Option for advanced program users TachoScan. The structure of the imported file is available in the "The structure of the imported xml file". |

|

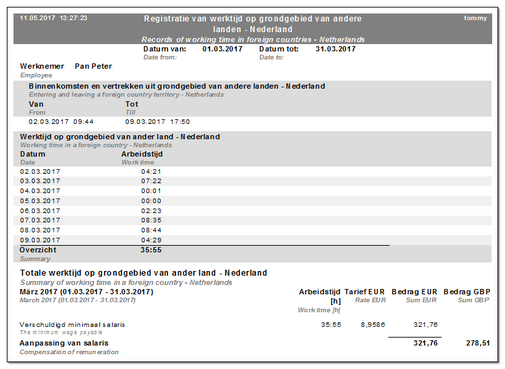

5.A detailed settlement of salary adjustment/reduction for the time of work on the territory of other countries is available in the report: Records of working time in foreign countries ("Reports" menu), which contains the following data:

•list of entries to and exits from the territory of "other country";

•summary of work time;

•summary of compensation calculated for the work time while in the territory "other country".

The remuneration due for working time in other countries is calculated according to ECB monthly exchange rate. Exchange rates are automatically downloaded by the program ("Basic data -> [009] Rates of exchange" menu). |

|

6.Other reports:

•"[179] Summary records of working time in foreign countries" - the list of final results of the compensation settlement for the time of work on the territory of "other country".